Summary:

Expanded IRS declaration requirements for taxpayers in Portugal.

Mandatory reporting of offshore assets, regardless of income.

Taxpayers must include in-kind payments and capital income over 500 euros in their declarations.

Uncertainty about whether the Tax Authority will pre-fill declarations.

Government positions itself against tax evasion while evaluating new reporting obligations.

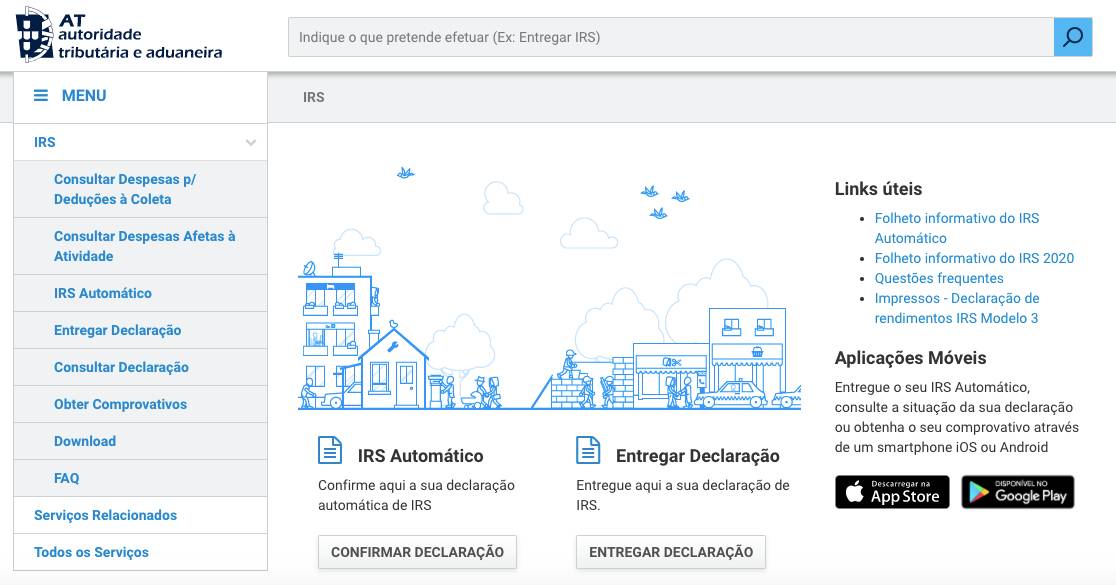

Expanded IRS Declaration Requirements

The IRS declaration in Portugal is set to expand significantly, requiring taxpayers to disclose a broader range of information than before. Notably, individuals with offshore assets, regardless of whether they generate income, must now report these holdings.

Additionally, taxpayers receiving in-kind payments—which typically escape taxation—must ensure these are included in their annual declaration. This change also applies to individuals with capital income exceeding 500 euros, who will need to report these amounts as well.

Authority's Role in Simplification

A key question remains: will the Tax Authority (AT) pre-fill these declarations as it does with other income, or will it require taxpayers to report each item individually? The Ministry of Finance, led by Joaquim Miranda Sarmento, has indicated that the new reporting obligations are still under evaluation and has redirected responsibility to the previous government for these changes.

These adjustments aim to enhance transparency and combat tax evasion, but they also raise concerns about the administrative burden on taxpayers.

For more insights on the implications of these changes, stay tuned as the situation develops.

Comments

Join Our Community

Create an account to share your thoughts, engage with others, and be part of our growing community.